In the AI boom, this company is suddenly flying high

Plus: Stunning natural gas stat and killer sunset

Scroll to the end for a 💯 Seattle sunset.

In the AI boom, this energy company is suddenly flying high

Meet the unlikely poster child for the AI boom and its insatiable energy demand.

Why it matters: Bloom Energy, long seen as a niche energy player, can deliver on-site power far faster than traditional options — a critical edge as data centers race to secure electricity.

Driving the news: Over the past year, Bloom Energy’s stock has surged more than 400%, outpacing even AI bellwethers like Nvidia.

State of play: Bloom Energy makes shipping container-sized fuel cell units that generate power with natural gas through a chemical reaction instead of combustion.

It has signed major deals with key players across the AI and energy landscape over the last year and a half. They include Oracle, utility AEP and Brookfield, a leading financier and owner of data center assets.

The stock price surged late Thursday after its earnings beat investor expectations earlier in the day.

“We went from zero hyperscalers directly talking to us to pretty much every hyperscaler talking to us,” Bloom Energy co-founder and CEO KR Sridhar said in an interview during last month’s World Economic Forum in the Swiss mountain town of Davos.

The sudden interest in the San Jose, Calif.-based company reflects how unusual the moment is for a firm that spent years pitching fuel cells to a market that largely wasn’t listening.

During the first half of 2025, “pretty much our phones wouldn’t stop ringing, and we had to be selective on who we were talking to,” said Sridhar, a physicist and materials scientist who previously worked on energy at NASA.

The big picture: The AI boom is scrambling winners and losers across the economy.

That’s been especially true in the electricity sector. It has long had stagnant growth and a reputation for moving slowly, constrained by regulations and years-long waits to plug into regional power systems.

Zoom out: Bloom Energy has had a long — and controversial — run. Founded 25 years ago by Sridhar, the company initially framed its technology as a clean-energy solution.

It even drew national attention with a “60 Minutes” segment in 2010.

Flashback: Axios reporting has chronicled some of Bloom’s earlier governance and disclosure controversies.

Bloom’s 2018 IPO filing included a surprising disclosure involving investors with ties to a firm sanctioned for misleading investors, and a 2019 Axios investigation flagged a history of unreliable projections.

“It’s a cautionary tale of what can happen when narrative overtakes results,” Axios’ Dan Primack wrote at the time.

Catch up fast: It now appears some results may be catching up with Sridhar’s long-running narrative — thanks to AI.

“We knew the day would come. We kept plugging away and AI came as a catalyst,” Sridhar said in our interview.

Reality check: Analysts at Jefferies raised its 2026 outlook for Bloom on stronger order visibility, according to a late January report by the investment bank.

But Jefferies is cautious longer term, citing competition, supply risks and limited margin for error at current valuations.

Learn how it works and more in the full story in Axios.

The AI boom is making natural gas great again

Natural gas is the clear winner in a fast-moving push to generate power directly at data centers, a new report finds.

Why it matters: These are billion-dollar bets that last decades — and doubling down on fossil fuel today locks in more global warming far into the future.

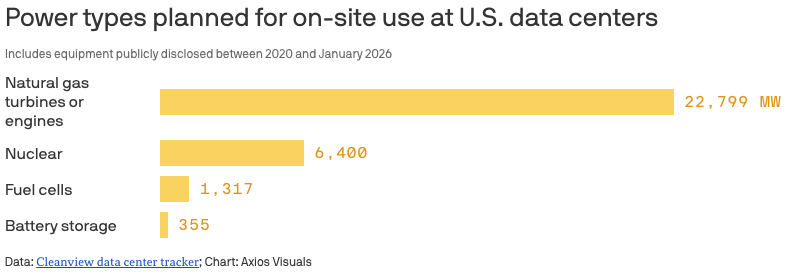

Driving the news: Nearly 75% of the power equipment planned to be used on site at data centers is natural gas, according to a report released Tuesday by Cleanview, a market intelligence platform.

“Press releases for these projects say one thing. But the 35+ permit documents, site plans, and equipment deals we found tell a much different story,” the report finds.

Despite public nods to renewables, hydrogen, or nuclear, the equipment being installed this year and next is “almost entirely gas-powered.”

By the numbers: Cleanview identified 46 data centers planning to build their own on-site power, with a combined capacity of 56 gigawatts.

That represents roughly 30% of all planned data center capacity in the United States.

It’s roughly five times the peak electricity demand of New York City.

Between the lines: “This is a very new trend,” Cleanview’s Michael Thomas wrote recently. “A little more than a year ago, virtually all data center developers planned to use the electric grid to power 100% of their projects.”

The big picture: Wind, solar, and batteries are cheaper in a lot of places. But the AI race is so intense that companies are choosing power they can get now over power that’s cheaper later, amid years-long grid connection delays.

“The rub for solar and wind developers is that they’re essentially locked out of this market until” developers begin building renewable-energy farms adjacent to data centers, Thomas told Axios in an interview.

Zoom out: Natural gas is already the largest source of electricity on U.S. power grids — and it’s also dominating data centers that do connect to the grid, particularly in the Mid-Atlantic and Midwest, the country’s AI hotbed.

Flashback: A decade ago, natural gas was becoming politically toxic, with some activists and lawmakers pushing to ban it alongside coal.

Now, as global climate ambitions falter and AI drives a race for power, gas is regaining political and commercial appeal.

Read how Bloom Energy fits into this in the full Axios story.

🏈 Go Seahawks! 🏈